The current ratio is a liquidity and efficiency ratio that measures a firm’s ability to pay off its short-term liabilities with its current assets. The current ratio is an important measure of liquidity because short-term liabilities are due within the next year. The current ratio, therefore, is called “current” because, in contrast to other liquidity ratios, it incorporates all current assets (both liquid and illiquid) and liabilities. The current ratio is one of the most common measures of liquidity. It refers to the ratio of current assets to current liabilities. In other words, it is defined as the total current assets divided by the total current liabilities.

Bankrate logo

This is based on the simple reasoning that a higher current ratio means the company is more solvent and can meet its obligations more easily. The owner of Mama’s Burger Restaurant is applying for a loan to finance the extension of the facility. To estimate the credibility of Mama’s Burger, the bank wants to analyze its current financial situation. Various factors, such as changes in a company’s operations or economic conditions, can influence it. Monitoring a company’s Current Ratio over time helps in assessing its financial trajectory. For instance, if a company’s Current Ratio was 2 last year but is 1.5 this year, it may suggest that its liquidity has slightly decreased, which could be a cause for further investigation.

Current Ratio Explained With Formula and Examples

The current ratio is called current because, unlike some other liquidity ratios, it incorporates all current assets and current liabilities. The current ratio is sometimes called the working capital ratio. The current ratio is balance-sheet financial performance measure of company liquidity. The current ratio indicates a company’s ability to meet short-term debt obligations.

How confident are you in your long term financial plan?

Both current assets and current liabilities are listed on a company’s balance sheet. Let’s look at some examples of companies with high and low current ratios. You can find these numbers on a company’s balance sheet under total current assets and total current liabilities. Some finance sites also give you the ratio in a list with other common financials, such as valuation, profitability and capitalization. You can calculate the current ratio by dividing a company’s total current assets by its total current liabilities.

How We Make Money

The current ratio is calculated using the formula shown below. The current assets are cash or assets that are expected to turn into cash within the current year. The current ratio reflects a company’s capacity to pay off all its short-term obligations, under the hypothetical scenario that short-term obligations are due right now.

- From 2020 to 2021, it jumps from 1.35 to 1.05 in a single year.

- Investors often use the Current Ratio to gauge a company’s financial stability and its ability to weather economic downturns.

- In short, these entities exhibit different current ratio number in different parts of the year which puts both usability and reliability of the ratio in question.

- Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

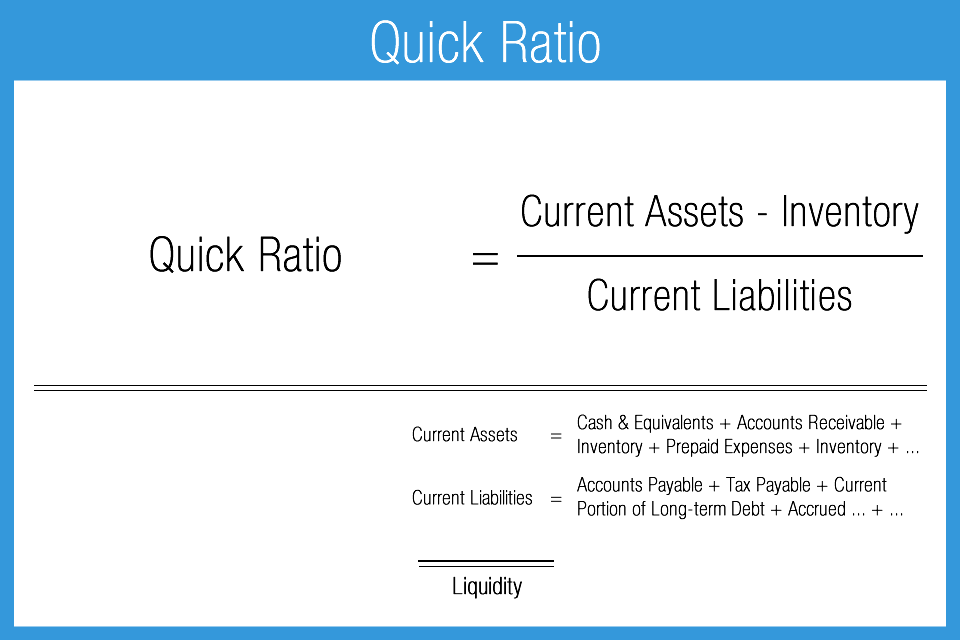

- Comparing the Current Ratio with other liquidity ratios, like the Quick Ratio or the Cash Ratio, can offer a more nuanced view of a company’s financial health.

On the flip side, if the current ratio falls below 1, it could be a red flag. This indicates that the company might not have enough short-term assets to settle its debts as they come due. This could lead to liquidity problems, which might require the company to borrow more or sell assets at unfavorable terms just to keep the lights on.

The following data has been extracted from the financial statements of two companies – company A and company B. A current ratio less than one is an indicator that the company may not be able to service the difference between fixed cost and variable cost its short-term debt. Understanding the Current Ratio empowers investors and analysts to make informed decisions, enabling them to navigate the intricate world of finance with confidence.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. So, a ratio of 2.65 means that Sample Limited has more than enough cash to meet its immediate obligations. We are an independent, advertising-supported comparison service. This includes all the goods and materials a business has stored for future use, like raw materials, unfinished parts, and unsold stock on shelves.

It’s one of the ways to measure the solvency and overall financial health of your company. In this example, Company A has much more inventory than Company B, which will be harder to turn into cash in the short term. Perhaps this inventory is overstocked or unwanted, which eventually may reduce its value on the balance sheet. Company B has more cash, which is the most liquid asset, and more accounts receivable, which could be collected more quickly than liquidating inventory.