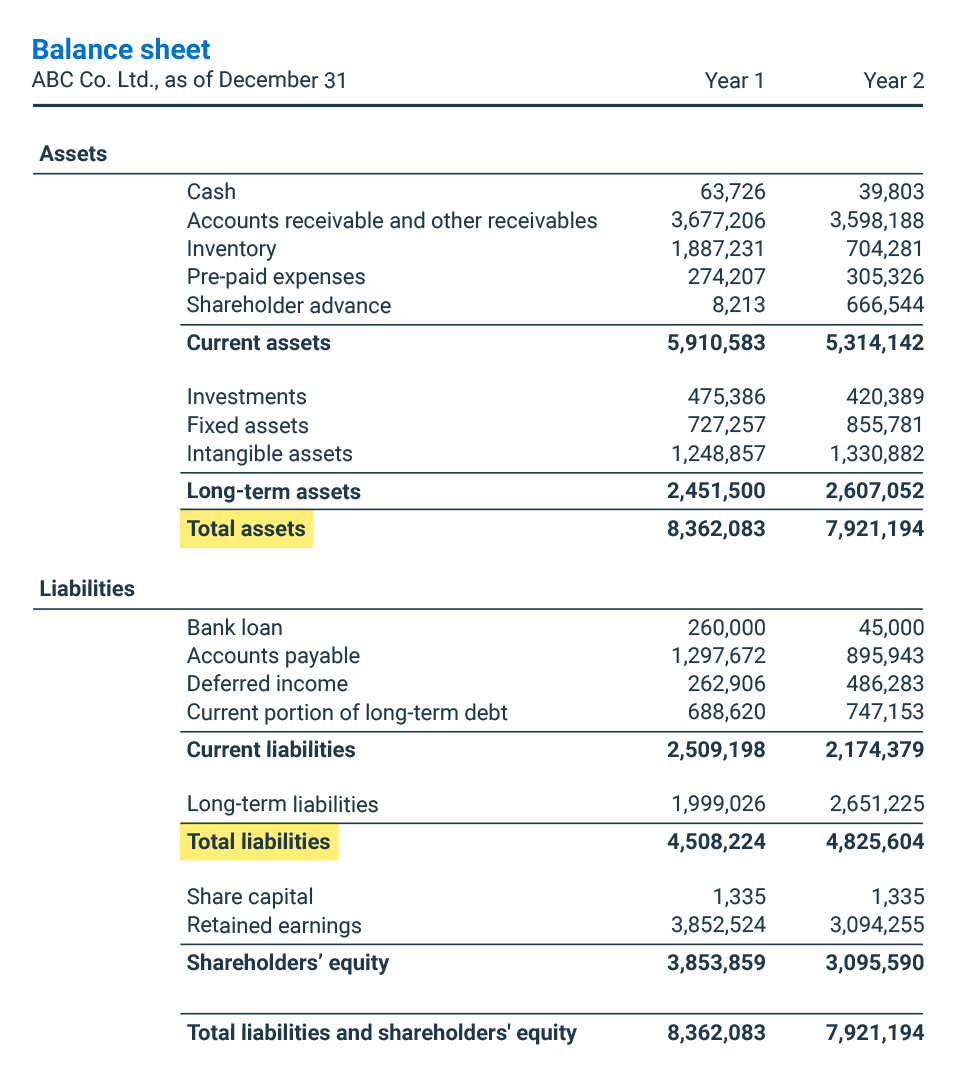

Everything listed there is an item that the company has control over and can use to run the business. In other words, if ABC Widgets liquidated all of its assets to pay off its debt, the shareholders would retain 75% of the company’s financial resources. Say that you’re considering investing in ABC Widgets, Inc. and want to understand its financial strength and overall debt situation.

What Is a Good Debt-to-Equity (D/E) Ratio?

If both companies have $1.5 million in shareholder equity, then they both have a D/E ratio of 1. On the surface, the risk from leverage is identical, but in reality, the second company is riskier. When using the D/E ratio, it is very important to consider the industry in which the company operates. Because different industries have different capital needs and growth rates, a D/E ratio value that’s common in one industry might be a red flag in another.

Salary & Income Tax Calculators

Changes in long-term debt and assets tend to affect the D/E ratio the most because the numbers involved tend to be larger than for short-term debt and short-term assets. If investors want to evaluate a company’s short-term leverage and its ability to meet debt obligations that must be paid over a year or less, they can use other ratios. These balance sheet categories may include items that would not normally be considered debt or equity in the traditional sense of a loan or an asset. Below liabilities on the balance sheet, you’ll find equity, the amount owed to the owners of the company.

Formula and Calculation of the D/E Ratio

It shows the relation between the portion of assets financed by creditors and the portion of assets financed by stockholders. When a company’s shareholder equity ratio is at 100%, it means that the company has all of its assets funded with equity capital instead of debt. This could happen because the company is generating strong earnings that paid debt over time and constituted more equity for the shareholders.

The D/E Ratio for Personal Finances

However, unlike liabilities, equity is not a fixed amount with a fixed interest rate. Other creditors, including suppliers, bondholders, and preferred shareholders, are repaid before common shareholders. As a gauge of financial leverage, it provides a snapshot of a company’s financial stability and risk profile.

Assets

Finally, if we assume that the company will not default over the next year, then debt due sooner shouldn’t be a concern. In contrast, a company’s ability to service long-term debt will depend on its long-term business prospects, which are less net operating profit after tax nopat certain. Business owners use a variety of software to track D/E ratios and other financial metrics. Microsoft Excel provides a balance sheet template that automatically calculates financial ratios such as the D/E ratio and the debt ratio.

- It is a measure of the degree to which a company is financing its operations with debt rather than its own resources.

- A year-end number is arrived at by using return on equity (ROE) calculation.

- This ratio is commonly used by investors, financial analysts, and creditors to measure a company’s risk, financial stability, and efficiency of its financial structure.

- Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company.

What counts as a “good” debt-to-equity (D/E) ratio will depend on the nature of the business and its industry. Generally speaking, a D/E ratio below 1 would be seen as relatively safe, whereas values of 2 or higher might be considered risky. Companies in some industries, such as utilities, consumer staples, and banking, typically have relatively high D/E ratios. On the other hand, the typically steady preferred dividend, par value, and liquidation rights make preferred shares look more like debt. If interest rates are higher when the long-term debt comes due and needs to be refinanced, then interest expense will rise.

The growing reliance on debt could eventually lead to difficulties in servicing the company’s current loan obligations. Very high D/E ratios may eventually result in a loan default or bankruptcy. A D/E ratio of 1.5 would indicate that the company in question has $1.50 of debt for every $1 of equity.

The Liabilities to Equity Ratio is a financial metric that assesses a company’s financial leverage by comparing its total liabilities to its shareholders’ equity. It’s an indicator of how a company is financing its operations and growth – whether it’s through debt (liabilities) or its own funds (equity). Debt-financed growth may serve to increase earnings, and if the incremental profit increase exceeds the related rise in debt service costs, then shareholders should expect to benefit. However, if the additional cost of debt financing outweighs the additional income that it generates, then the share price may drop.

The numerator in above formula consists of total current and long-term liabilities and the denominator consists of total stockholders’ equity, including preferred stock, if any. Both the elements of the formula can be obtained from company’s balance sheet. The shareholder equity ratio is expressed as a percentage and calculated by dividing total shareholders’ equity by the total assets of the company. The result represents the amount of the assets on which shareholders have a residual claim. The figures used to calculate the ratio are recorded on the company balance sheet.

He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. Understanding the Liabilities to Equity Ratio can offer invaluable insights into a company’s financial health and stability.